Content

The first method involves measuring the contribution margin for a product and dividing it by the total product units manufactured. In this case, the contribution per unit https://www.bookstime.com/ formula will be as follows. For example, renting an office space would be considered a fixed cost, as it will not be affected by how many units of your product you make.

So, if you can lower your logistic cost, you can reduce the cost per good and service. As per the experts, you are improving your supply chain’s efficiency, making it possible to lower storage costs, first-mile delivery, and fulfillment costs. The first-mile delivery cost can be reduced by lowering the distance between distribution centers and suppliers. On the other hand, by working with a professional 3PL or automating the fulfillment process, you can reduce the fulfillment cost.

Example of the Cost per Unit

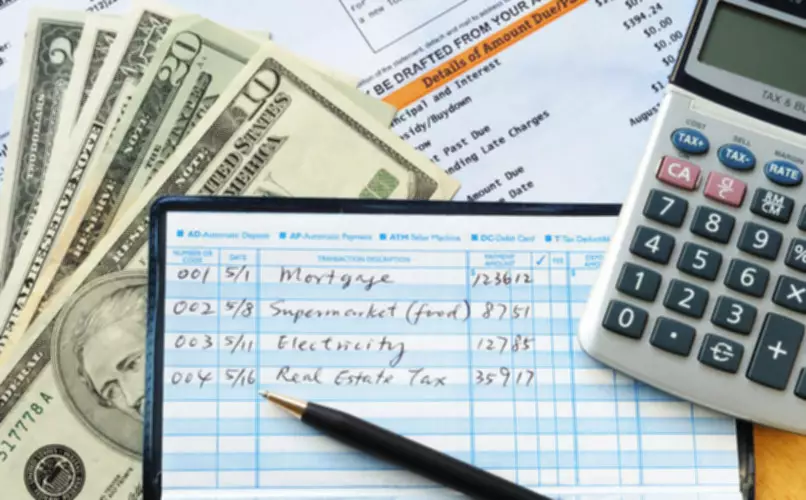

For example, if the cost per unit is USD 80 and the company charges USD 150 per unit, the customers may not purchase the product and will look for an alternative. However, to calculate cost per unit accurately, you will have to understand fixed and variable costs. As you have seen, it’s important to keep a detailed record of your expenses so that you can plan ahead. Specifically, you need to distinguish between fixed and variable costs, as the second will always increase the more you produce. It’s important to note that reality is a little less clear-cut, so you also need to know about semi-variable costs. There are costs that are often considered fixed but can become variable after a certain threshold has been reached, or they have a variable component.

What is the formula for cost per unit in process costing?

Calculate cost per unit: Divide the total cost by the number of units. This calculation includes both completed units and equivalent units. So, if a business completed 4,000 products and another 1,000 units got halfway through production, the applicable costs would be divided by 4,000 + (1,000/2) = 4,500 units.

But you might charge your customers $2.50 per cookie, which is the price per unit. This means the company must price each unit at more than $21.25 to cover costs and make a profit. The monthly fixed costs are $6,500, including rent, salaries, and insurance premiums.

Remove unprofitable products

Gross profit and a company’s gross profit margin (gross profit divided by sales) are the leading metrics used in analyzing a company’s unit cost efficiency. A higher gross profit margin indicates a company is earning more per dollar of revenue on each product sold. Moreover, the variable cost per unit of production is $4.00, so the total variable costs incurred over the how to calculate cost per unit course of the fiscal year were $100,000. When fixed costs are high, you need more volume to break even, but your profits will be higher when you continue to increase that volume. Businesses with high fixed costs generally operate differently than those with high variable costs. AccountingTools states that the cost per unit should decrease as unit production increases.

Another way to look at variable costs is if you were to stop producing any products, then there should be no variable costs on your spreadsheet. Now that you know the total variable costs and the number of units made for each product, it’s easy to work out the variable cost per unit. Unlike fixed costs, which remain the same no matter how much you produce, variable costs increase the more you produce. For this reason, it’s important to ensure that all variable costs are accurately recorded. In January, the unit cost of a pen was $1 if 50,000 units were produced, with direct labor and direct material costs being $15,000 and $16,000, respectively.

How to calculate Contribution Per Unit?

Examples are production costs, customer acquisition, packaging, and shipping costs. Total fixed costs remain the same, no matter how many units are produced in a time period. As the owner of a small business, you can see that any decision you make about pricing your product, the costs you incur in your business, and sales volume are interrelated. Calculating the breakeven point is just one component of cost-volume-profit analysis, but it’s often an essential first step in establishing a sales price point that ensures a profit. A unit cost is a total expenditure incurred by a company to produce, store, and sell one unit of a particular product or service. Investopedia identifies the unit cost as a breakeven point because it is the minimum price at market that will cover production costs.

- The cost per unit is derived from the variable costs and fixed costs incurred by a production process, divided by the number of units produced.

- Only when you know how much it costs to produce or procure a single unit of any SKU can you make more informed decisions on how much to sell it for.

- Private and public companies account for unit costs on their financial reporting statements.

- The unit cost is the amount of money it takes to produce one unit of an item.

- Contribution margin only considers variable expenses when calculating returns for products.

Our innovative tool allows you to easily prioritize delivery stops and manage multiple routes, saving you valuable time and fuel costs. And by implementing effective customer management practices, you can make sure orders are fulfilled on time and customers are satisfied with their purchases. You can reduce these costs by taking a comprehensive look at your business operations and identifying areas where you can make adjustments. One way to reduce these costs is by using Circuit for Teams to optimize delivery routes.

Resources for Your Growing Business

The per unit price is the price of an item per each unit that is purchased or sold. This is the same as the unit price, but worded in a different way. A cost per unit is a metric used to describe the cost to produce, purchase, buy, etc one unit of anything. Businesses are the usual organizations that use unit cost but other organizations like government agencies can use them too to get a better understanding of finances.

What is cost unit with one example?

A unit of production for which the management of an organization wishes to collect the costs incurred. In some cases the cost unit may be the final item produced, for example a chair or a light bulb, but in other more complex products the cost unit may be a sub-assembly, for example an aircraft wing or a gear box.

This lets you reduce overhead expenses, streamline operations, and increase profits. Reduce your cost per unit and increase operational efficiency by optimizing your delivery process with Circuit for Teams. The Average Cost, or “per unit cost”, is an economic term that describes the approximate cost incurred to manufacture one production unit. It is essential to calculate cost per unit as it offers an idea of how much you need to charge per product to generate profit. If you know what sales volumes to anticipate, you can manage your inventory accordingly to reduce costs. Dealing with these common inventory challenges can hike up logistics costs, from higher storage costs to returns management (e.g., shipping labels, processing and restocking).